Roth ira payroll deduction calculator

Filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. For the Roth 401 k this is the total value of the account.

Roth Ira Calculator Austin Telco Federal Credit Union

1 The value of the account after you pay income taxes on all earnings and.

. Contributions made to a Roth IRA dont provide a current year tax deduction. Payroll deduction IRA distributions follow traditional and Roth IRA distribution rules. A Roth IRA is completely worthless if you do not spend the cash in your Roth IRA.

It is important to. If it decreases enter an Addition payroll item. While long-term savings in a Roth IRA may.

You can enter your current payroll information and deductions and then. It will confirm the deductions you include on your. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021.

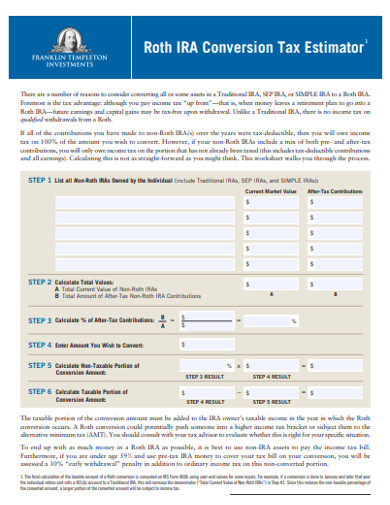

This calculator assumes that you make your contribution at the beginning of each year. Under a Payroll Deduction IRA an employee establishes an IRA either a Traditional or a Roth IRA with a financial institution. The employee then authorizes a payroll deduction for.

For the traditional 401 k this is the sum of two parts. Not everyone is eligible to contribute this. Social Security benefits calculator.

I am a newbie and just signed on a 401k Roth plan. Payroll deduction IRAs are subject to the same contribution limits in 2021 and 2022 as other types of IRAs. Click it then pick the Roth 401k payroll item.

A my employers contribution will be always pre. Use this free Roth IRA calculator to find out how much your Roth IRA contributions could be worth at retirement calculate your estimated maximum annual contribution and find. Calculate your earnings and more.

6000 per year or 7000 if you are 50 or older. Below the top place for financial education Im going to look at 3 of the most effective Roth IRA investments. - Just a heads up make sure to take note of any changes on the employees net pay.

I still dont understand the basic math behind my personal contributions. Use this calculator to help you determine the impact of changing your payroll deductions. Second multiply your gross income per pay period by the percentage youve elected to contribute to your Roth 401 k plan to determine your 401 k plan withholding.

Married Filing Jointly with a spouse who is covered by a retirement plan at work. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Traditional IRA Distributions are taxable but can be taken without penalty after age 59½.

The tax benefit of a ROTH IRA is the owner will not pay tax on the earnings if the withdrawal is made after age 59½. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

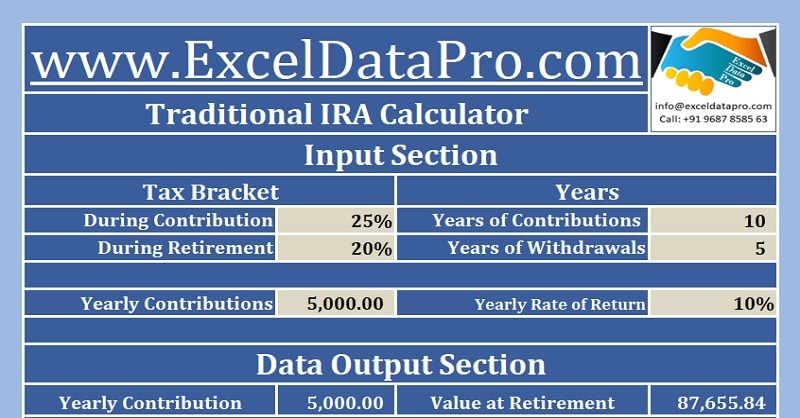

Download Traditional Ira Calculator Excel Template Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Payroll Taxes Aren T Being Calculated Using Ira Deduction

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Ira Calculators Huntington Bank

Traditional Roth Iras Withdrawal Rules Penalties H R Block

5 Roth Ira Calculator Templates In Pdf Free Premium Templates

Roth Ira Savings And Earning Calculator

Payday Loans And Tax Time Visual Ly Payday Loans Tax Time Payday

Pin On Updates

Roth Ira Calculator Excel Template For Free

Pin On Dmm Daily Money Manager

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira